Since the start of the full-scale invasion, Zaporizhzhia has endured more than 6,500 air raid alerts lasting nearly 7,000 hours in total. Russian attacks have completely or partially destroyed over 700 industrial facilities, 600 infrastructure sites, and 600 social and cultural institutions. According to World Bank estimates, total losses for Zaporizhzhia region amount to $61.2 billion, the highest figure among all frontline regions.

DOZORRO TI Ukraine examined how public procurement was conducted in Zaporizhzhia city and region during 2024 and the first nine months of 2025. Under wartime conditions, procurement becomes a kind of mirror reflecting the region’s reality. It shows where funds are directed, where there are risks of inflated prices, and how efficiently authorities manage limited resources amid the ongoing war.

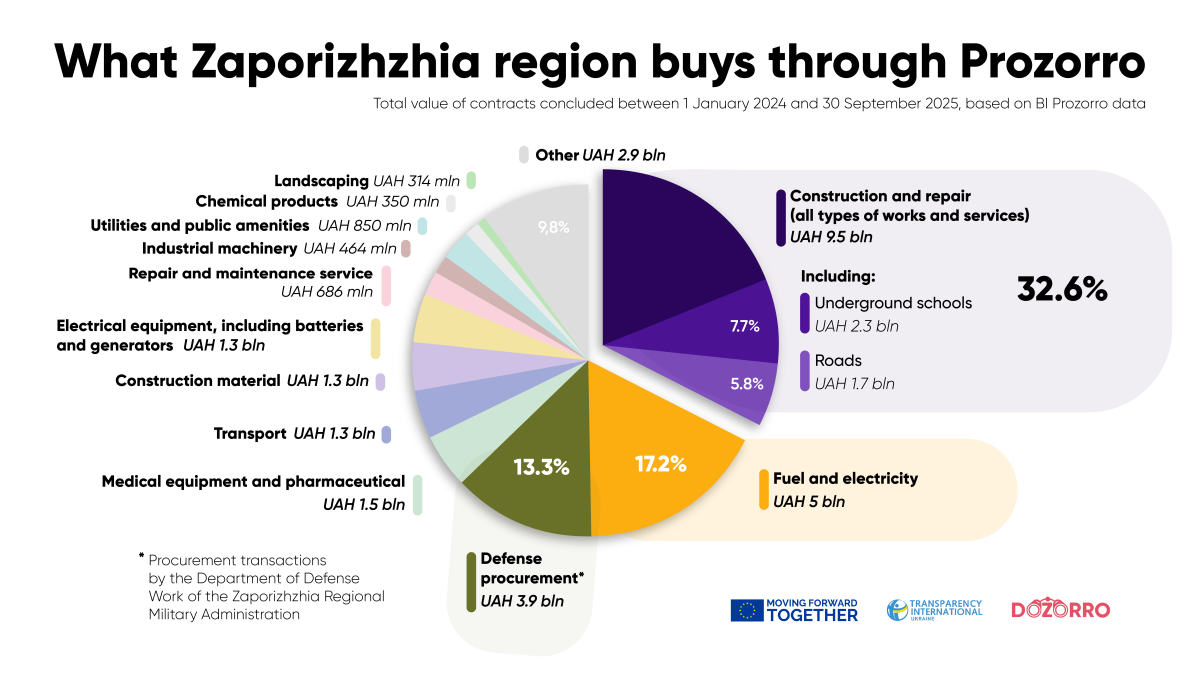

UAH 29 billion: where the money goes

In 2024 and the first nine months of 2025, over 80,000 contracts worth UAH 29.3 billion were concluded in Zaporizhzhia region, according to the BI Prozorro public analytics module. It should be noted that the analysis covers contracted amounts, not actual disbursements.

In 2024, procuring entities committed UAH 15.7 billion, and in the first nine months of 2025 — another UAH 13.6 billion. The largest share (almost one-third) went to construction, totaling UAH 9.5 billion. The next largest category was fuel, electricity, and lubricants — UAH 5 billion, followed by UAH 3.9 billion for unmanned aerial vehicles, Mavics, pickup trucks, quad bikes, and other military-related goods.

By contract value, 55% of procurement transactions were conducted through special open bidding, 24% were direct contracts, 13% through requests for price quotations, and 8% through simplified procurement procedures.

On average, 2.4 companies competed per tender announced in the region — exactly the same as the national average, according to BI Prozorro data.

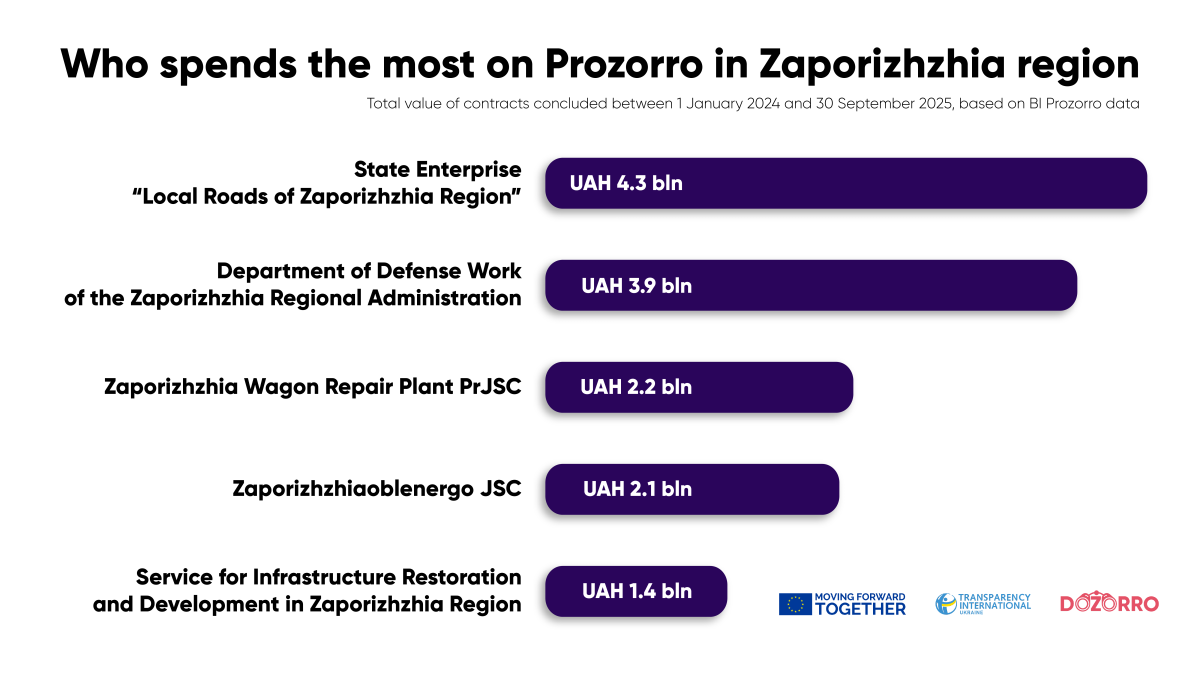

The largest procuring entities

The largest procuring entity was State Enterprise “Local Roads of Zaporizhzhia Region”, with UAH 4.3 billion in contracts. These included construction of underground schools, hospital facilities, building reconstruction, and road maintenance. The second largest was the Department of Defense Work of the Zaporizhzhia Regional Administration, with UAH 3.9 billion in contracts — mostly for military goods, including drones.

The third was Zaporizhzhia Electric Locomotive Repair Plant PJSC, with UAH 2.2 billion in contracts, covering procurement of various materials and components, such as bandages, springs, bearings, and compressor spare parts.

The 2024 procurement volume is three times lower than before the full-scale invasion. In 2021, the city signed contracts worth UAH 47.2 billion, in 2022 — only UAH 7.9 billion, and in 2023 the figure rose to UAH 19.7 billion.

Largest construction and repair contracts

The most expensive construction contract was signed in May 2025. State Enterprise “Local Roads of Zaporizhzhia Region” commissioned the construction of a new building on the premises of the Zaporizhzhia Regional Children’s Hospital. The works, worth UAH 440 million, are being carried out by Kalmius LLC, which was established a month before the tender announcement. Its owner, Danylo Sandyriev, is reportedly linked to MP Serhii Minko, according to 368.media. Kalmius ranked fourth by total contract value in the region, with UAH 781.7 million in signed agreements.

The project includes the construction of a six-story building with a modern protective shelter, featuring an operating room and an intensive care ward with 20 beds. Completion is scheduled for the end of 2026. Excavation and foundation work are already completed, and the reinforced concrete slab of the shelter has been poured.

As this is the region’s largest construction contract, DOZORRO reviewed the cost estimate and found a potential overpayment of UAH 32 million. However, since the contract price is dynamic, it can be adjusted during project execution. DOZORRO sent a formal letter to the procuring entity with overpayment calculations and a request to revise inflated prices. In response, the procuring entity noted that the dynamic pricing clause allows future price adjustments in the work completion certificates.

Another major project is the reconstruction of the Emergency and Ambulance Hospital in Zaporizhzhia, damaged by Russian shelling. The works were estimated at UAH 327 million, including façade insulation, replacement of windows and doors, and repairs of premises, roofing, and the ambulance canopy. The tender was won by Interpen-D LLC, owned by Oleksandr Malov. The company’s bid did not include cost estimates, making price verification impossible.

In April 2025, another contract worth UAH 164 million was signed with the same company for additional works. Analysts identified a possible overpayment exceeding UAH 1 million, though the dynamic contract price again allows later adjustments. Interpen-D LLC has been mentioned in several criminal proceedings, including cases concerning the embezzlement of budget funds during the procurement of ventilation systems for a children’s hospital in Dnipro and the repair of a shelter.

According to the procuring entity’s response, the contractor has already completed interior finishing, plumbing and sewage installation, electrical works, and façade insulation. Currently, landscaping, fire alarm, ventilation, and low-voltage system installations are underway.

The third-largest contract concerns the major repair of School No. 53 in Zaporizhzhia. The Department of Education and Science of the Zaporizhzhia City Council signed a UAH 198 million contract in April 2025 with the Globus-Bud-Industry consortium, founded by Garant-Stroi 2007 and Dinatron-Group LLC. The ultimate beneficiaries are Maksym Zakizianov and Dmytro Skliar. The renovation is scheduled for completion by the end of this year. According to the department’s response, 35% of the work is currently complete.

DOZORRO reviewed the cost estimate and identified a potential overpayment of UAH 5.1 million. A letter with detailed calculations was sent to the procuring entity, but no response was received. Given the dynamic price clause, there is still a chance the price will be adjusted to market levels during implementation.

Construction of underground schools

In relatively safe regions of Ukraine, students can attend classes in regular classrooms and move to shelters during air raids. For frontline cities, this model is unsafe and impractical: air raids can last most of the day, leaving no real time for learning. Therefore, underground schools are being built — an initiative that began in Kharkiv and later expanded to Zaporizhzhia. The main procuring entity is Local Roads of Zaporizhzhia Region.

Between 2024 and 2025, the enterprise signed UAH 2.2 billion worth of contracts for underground schools — UAH 1.17 billion in 2024 and UAH 1.1 billion in 2025. The contracts were awarded to several companies: Vivat Bud LLC, Melsiti LLC, Esko Zaporizhzhia, Company Positive, Kalmius, “Adonia Company, and Metkom Invest. According to the procuring entity, five underground schools have already been completed and put into operation, while 19 more are still under construction.

The first tender for such a school was announced in May 2024, for Zaporizhzhia Gymnasium No. 107, with an estimated value of UAH 111.6 million. Only one bidder participated — Melsiti LLC, which won with a proposal of UAH 110.6 million.

The most expensive underground school is being built for Zaporizhzhia Academic Lyceum No. 31, with a UAH 115.2 million contract signed in March 2025 with Esko Zaporizhzhia.

The DOZORRO team closely monitors the construction of underground schools in Zaporizhzhia. Between 2024 and 2025, analysts reviewed 15 procurement transactions and found potential overpayments of UAH 170 million in 12 of them. All the contracts have dynamic pricing, allowing cost revisions during implementation.

Implementation challenges

The largest regional procuring entity, State Enterprise “Local Roads of Zaporizhzhia Region”, described key challenges in public procurement to DOZORRO. The company manages not only road maintenance but also underground schools, hospitals, and residential reconstruction.

On average, only one bidder participates in its tenders, compared to 2.5 before the full-scale invasion. The procuring entity attributes this to wartime risks — businesses are reluctant to operate in a frontline region where workers risk their lives, and equipment can be destroyed overnight. The state does not compensate for injuries or destroyed machinery, discouraging participation.

The enterprise director, Viktoriia Repashevska, notes that on some days, the total duration of air raid alerts can reach 6.6 hours. As a result, construction companies are forced to seek a compromise: either ignore the alerts and stay on schedule, thereby putting their workers at risk, or comply with safety regulations and face penalties for failing to meet deadlines.

Additional challenges include economic decline — the number of businesses in the region has fallen by almost half, from 84,000 in 2021 to 46,000 today. Many firms have relocated, reducing competition and increasing project failure risks. Other issues include worker mobilization and family relocations due to closed kindergartens and limited schooling.

Inna Vnukova, head of the Service for Infrastructure Restoration and Development in Zaporizhzhia Region, also shared challenges in public procurement. Her agency handles road maintenance, residential restoration, and construction of transformer shelters.

She told DOZORRO that contractors often lack sufficient workers, despite formally confirming staff availability. High staff turnover, particularly due to mobilization, compounds the issue. Still, the director of the Service for Infrastructure Restoration and Development emphasizes that the works are being carried out according to schedule.

According to BI Prozorro, her agency’s procurements attract nearly two bidders on average, reflecting moderate competition under current conditions. Before the war (2019–2021), the average was 2.6 participants. The agency has not adopted additional measures to stimulate competition beyond standard tender announcements.

Many drones for the defense forces

Zaporizhzhia region is actively procuring military goods. The Department of Defense Work is the largest buyer, with UAH 3.9 billion in contracts. They procured, among other things, unmanned ground vehicles — TARGUN 2K, TARGUN 200, and the TerMIT robotic system.

Most spending goes to drones. According to Army PRO, in just the first half of 2025, UAH 1.14 billion was spent on UAVs — more than any other region, with Vinnytsia trailing by over UAH 800 million.

In total, UAH 2.9 billion was contracted for UAVs in 2024–2025 (UAH 1.3 billion in 2024 and UAH 1.6 billion in 2025). The largest supplier is 007M LLC, which received UAH 334 million.

These drone tenders have attracted media attention. NGL.media reported that the department signed multi-million contracts with individual entrepreneurs who had no prior defense experience, and some existed only on paper. Also, some contracts were not published on Prozorro, directly violating legal requirements.

Nevertheless, most of the department’s spending followed competitive procedures: 49% via special open bidding; 42% via requests for price quotations, and only 9% through direct contracts.

Beyond drones, the department also procures generators, charging stations, quad bikes, pickups, and other defense-related equipment.

Roads and landscaping

More than UAH 1.7 billion was contracted for road maintenance and repair in Zaporizhzhia region. The largest contract, worth UAH 520 million, was signed by the Service for Infrastructure Restoration and Development with Amstrud LLC for the maintenance of national roads within the government-controlled territory and care of artificial structures.

The contract runs until March 2026, and total agreements with the company in 2024–2025 reached UAH 643.4 million, placing it among the top five contractors.

Parallel to this, over UAH 200 million was allocated for landscaping and green space maintenance. The largest contracting authority in this area is the Department for Environmental Safety of the Zaporizhzhia City Council, which last year signed UAH 133 million in contracts with the municipal enterprise Zelenbud. The scope includes hedge trimming, tree watering, branch removal, winter root protection, plant rejuvenation, and flower planting.

Procurement of electrical equipment

Due to the constant threat of blackouts caused by Russian attacks, Zaporizhzhia city and region are investing heavily in energy resilience. Over UAH 386 million has been contracted for this purpose (excluding generators for the Armed Forces of Ukraine).

The largest contract was signed by Municipal Heating Networks for three 2.5 MW cogeneration units, supplied by Dalgakiran Compressor Ukraine for UAH 274 million. The Slovak-made equipment was financed by UNICEF.

Another UAH 153 million went toward generators for critical infrastructure, including a UAH 77 million contract by Municipal Water Utility for four generators to ensure uninterrupted water supply during large-scale power outages.

A major tender worth UAH 270 million is ongoing for the reconstruction of Zaporizhzhia’s district heating system, which will include gas piston cogeneration units capable of producing electricity and heat simultaneously.

This material is funded by the European Union. Its content is the sole responsibility of Transparency International Ukraine and does not necessarily reflect the views of the European Union.