Since the launch of online auctions on Prozorro.Sales in 2018, local budget revenue from the sale of municipal property has surpassed UAH 5 billion. This result was achieved after more than 4,200 tenders were held, with an average of nearly three participants per tender. Due to increased competition, the value of property sold by communities has risen by more than 1.5 times the starting price.

However, not all procedures for the sale of municipal property are transparent or competitive. The relevant legislation allows for the privatization of leased municipal property through a buyout by a tenant (hereinafter referred to as “buyout”). That mechanism may be implemented:

- outside the auction;

- at the price determined by the evaluation results;

- provided that a tenant makes integral improvements to the leased property in the amount of at least 25% of the market value of the property.

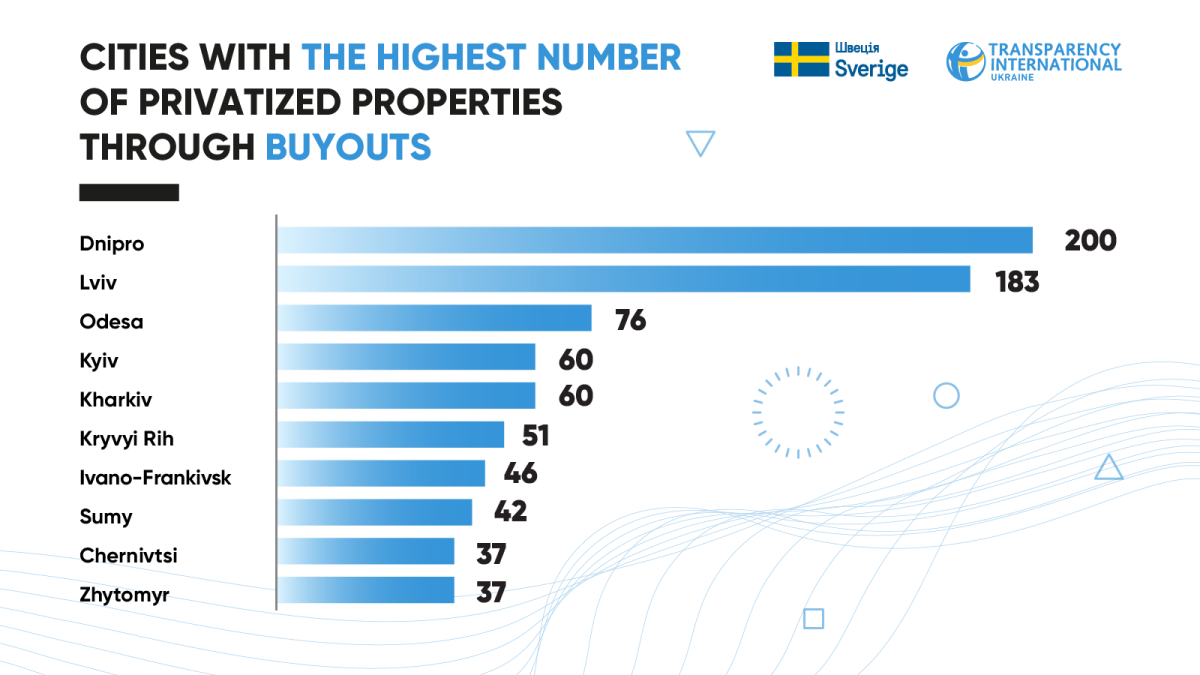

According to the analytics module of Prozorro.Sales, since 2018, more than 1,200 municipal property items have been purchased through buyout for a total of UAH 2.1 billion. These statistics make buyout the second most popular method of privatizing municipal property, after auctions. In a number of communities, including large cities such as Dnipro, Odesa, Sumy, and Zhytomyr, buyout is the preferred method.

The sale of a property item at auction begins with setting its starting price based on the book value, with the final price determined by the auction results. In the case of a buyout, the starting sale price is determined based on a property assessment and does not increase thereafter. Given this contrasting approach, TI Ukraine decided to compare the quantitative and financial indicators of the two main mechanisms for selling municipal property to assess their effectiveness in terms of filling local budgets.

We contacted 105 local self-government bodies with requests for information on the results of municipal property privatization from January 2019 to October/November 2024. For the analysis, we used data from 82 local authorities in areas where at least one municipal property item was privatized during this period.

Summary

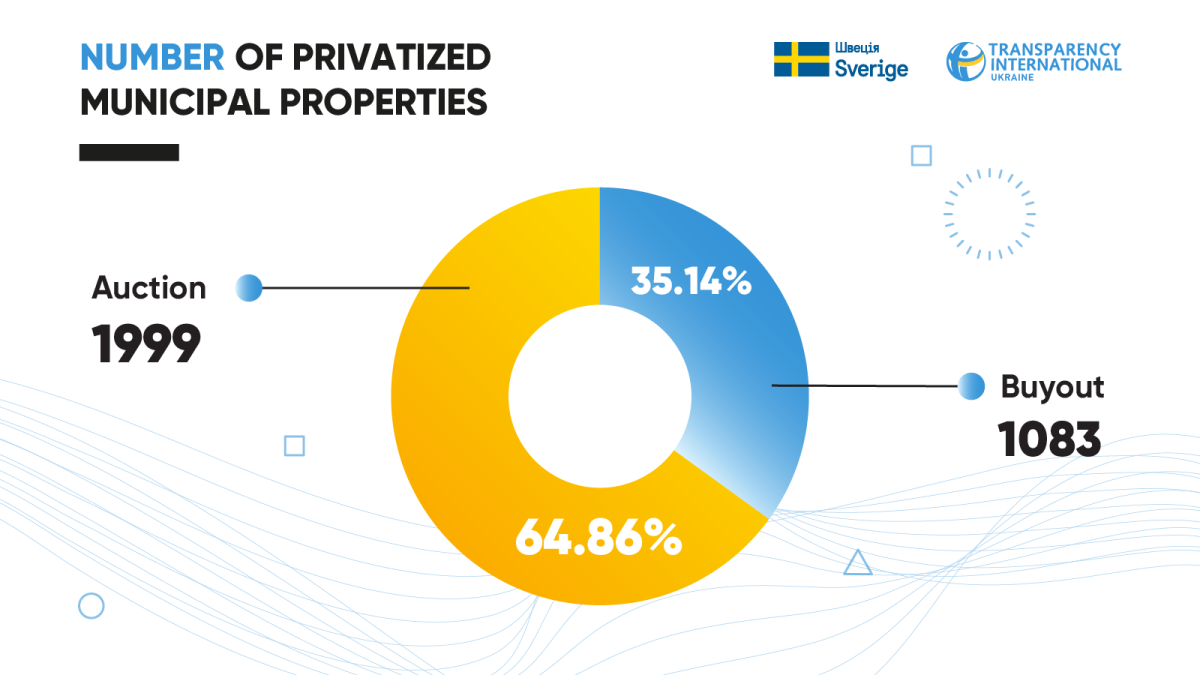

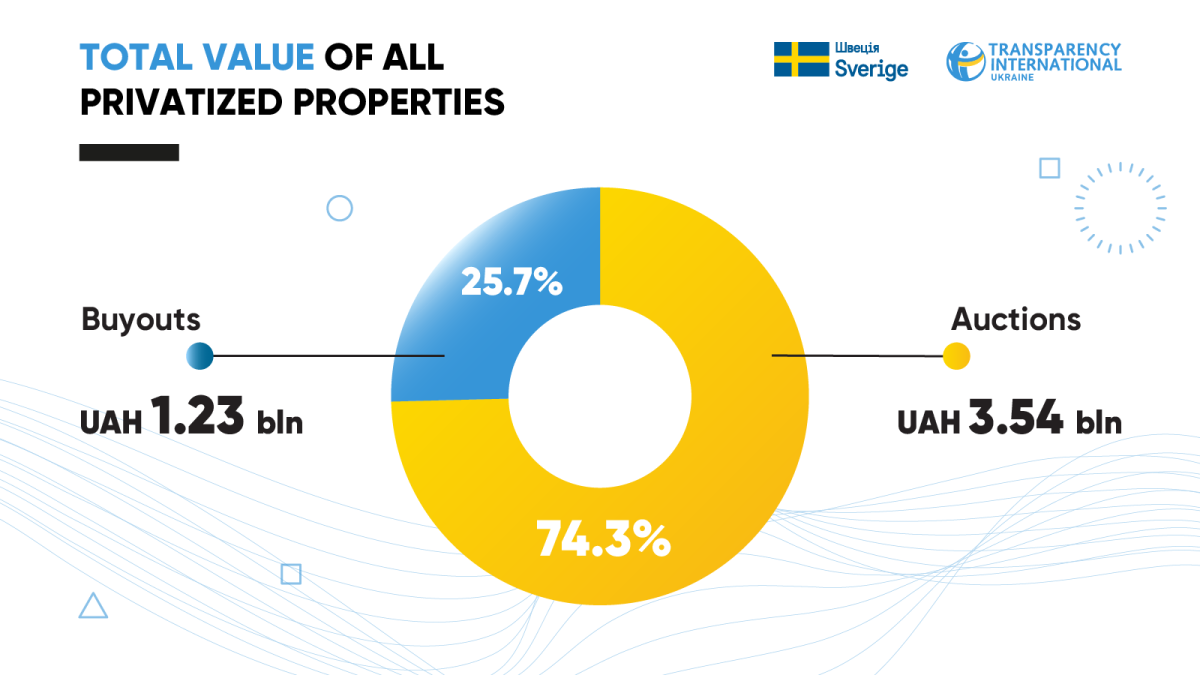

From January 2019 to October/November 2024, over a third of all privatized municipal properties were acquired through the buyout of leased assets. However, the total sale price of these properties accounted for just over a quarter (UAH 1.23 billion) of the total value of all privatized assets (UAH 4.77 billion).

An analysis of data from local authorities on municipal property privatization revealed that the average value of properties sold at auction is 45% higher than those privatized through buyouts. Based on this indicator, the budgets of cities using the buyout mechanism may have lost approximately UAH 552 million over nearly six years. Therefore, the economic impact of the buyout mechanism is significantly lower compared to the competitive privatization of properties.

Given this, it would be prudent to reconsider the approach to municipal property privatization and eliminate the tenant’s right to non-competitive buyout of property. An alternative could be the auction mechanism, with the tenant’s pre-emptive right to purchase the property at the highest price offered during the auction. This practice is already used in certain areas, in particular land auctions.

This mechanism in privatization is outlined in draft law No. 12215, and TI Ukraine supports its adoption by Parliament to ensure more effective management of municipal property.

The methods and scale of municipal property privatization

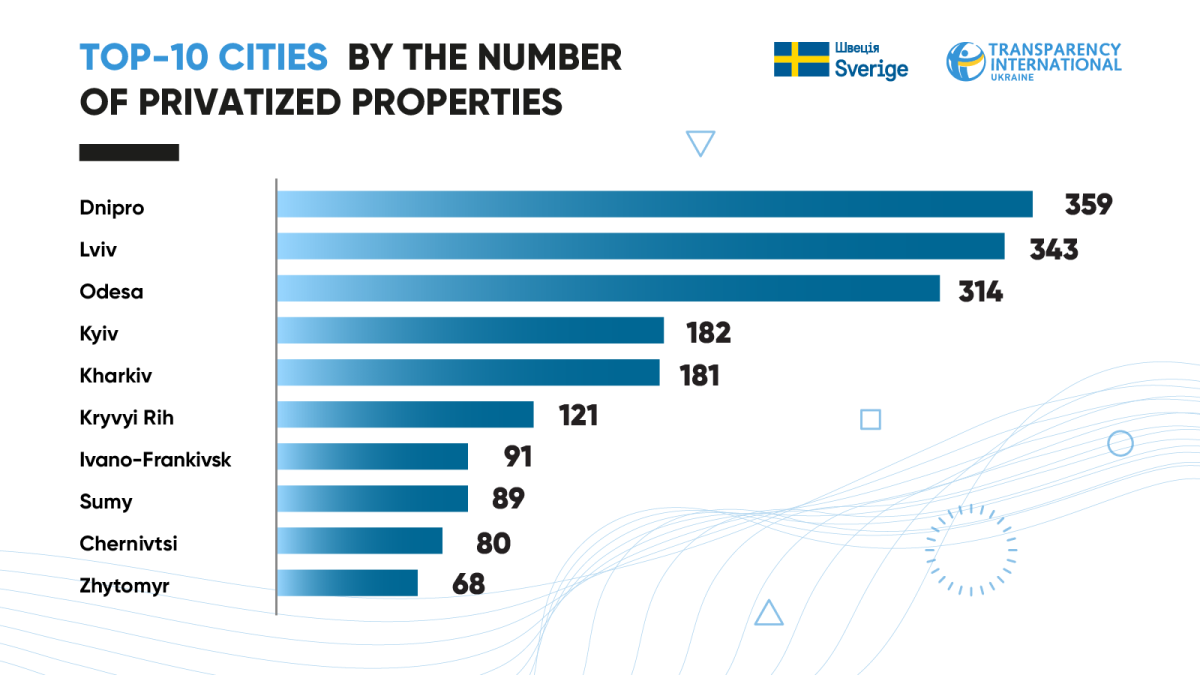

Between 2019 and 2024, a total of 3,082 municipal property items were privatized across 82 cities in Ukraine. Nearly half of these properties (1,500) were sold in six Ukrainian cities: Dnipro (359), Lviv (343), Odesa (314), Kyiv (182), Kharkiv (181), and Kryvyi Rih (121).

Meanwhile, in 30 cities — over a third of those analyzed — investors privatized fewer than a dozen properties in under six years. These include Lutsk (8), Zviahel (8), Horishni Plavni (7), Pervomaisk (5), and Chornomorsk (2).

In another 13 cities, including Mykolaiv, Konotop, and Myrhorod, not a single property was privatized. These cities were excluded from the analysis.

Making inherent improvements worth at least 25% of the market value of the leased property grants a tenant the right to buy it out. However, under the law, the final decision on the method of selling leased property is made by the local privatization authority.

According to data from local authorities, more than 41% of all privatized municipal property items were leased before being sold since 2019. The lion’s share — 1,083 properties, or nearly 85% — were sold through buyout. At the same time, in only 1 out of 6 cases, local privatization authorities choose to sell leased property at auction.

Frequency of buyout of municipal property items by cities

| City | Total number of privatized properties | Number of privatized properties through buyout | Frequency of buyout applications |

| Kamianske | 15 | 14 | 93% |

| Kropyvnytskyi | 41 | 37 | 90% |

| Uzhhorod | 41 | 37 | 90% |

| Kamianets-Podilskyi | 23 | 20 | 87% |

| Zaporizhzhia | 49 | 42 | 86% |

| Sumy | 89 | 76 | 85% |

| Zhytomyr | 68 | 51 | 75% |

| Odesa | 314 | 183 | 58% |

| Dnipro | 359 | 200 | 56% |

| Ivano-Frankivsk | 91 | 46 | 51% |

| Kryvyi Rih | 121 | 60 | 50% |

| Kyiv | 182 | 60 | 33% |

| Khmelnytskyi | 33 | 3 | 9% |

| Chernihiv | 54 | 2 | 4% |

| Lviv | 343 | 4 | 1% |

| Kharkiv | 181 | 0 | 0% |

In total, the buyout has been used at least once as a mechanism for privatizing municipal property in 50 cities (60.97% of those analyzed). Meanwhile, in 19 localities (23.17%), including Kropyvnytskyi, Uzhhorod, Zaporizhzhia, Sumy, Odesa, and Dnipro, the buyout was preferred over auctions, with the percentage of municipal property sold this way exceeding half of the total privatized properties. In 3 cities — Horishni Plavni, Svitlovodsk, and Chornomorsk — every property was privatized through this method.

However, this practice was not common across all cities. In Khmelnytskyi and Chernihiv, buyout was applied in less than 10% of municipal property privatizations. In Lviv, one of the leaders in the number of privatized properties, buyout was used in only 1% of cases. Meanwhile, in Kharkiv, Pokrov, Nizhyn, and 29 other cities, it was not used at all.

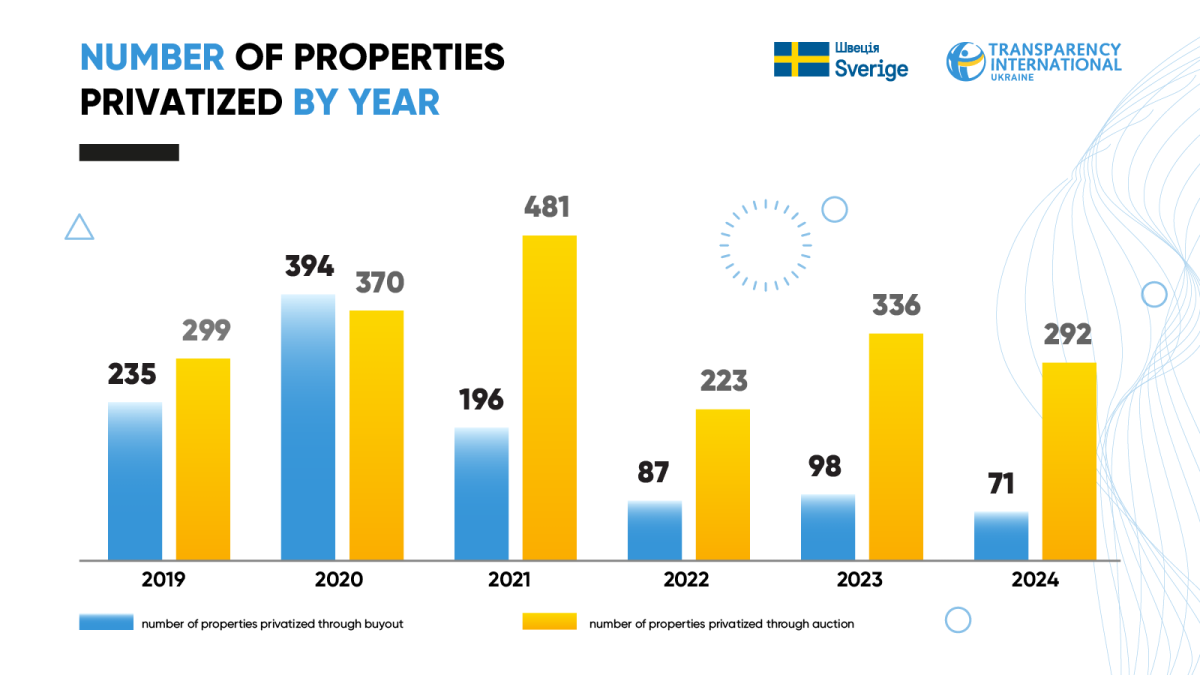

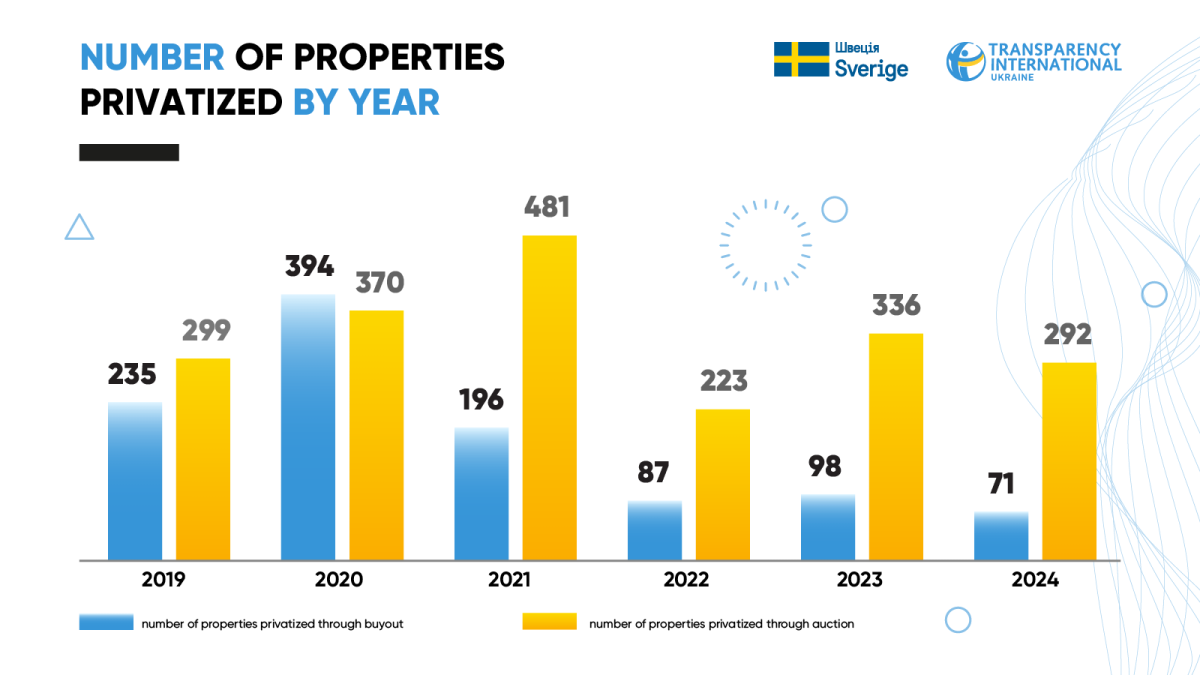

Between 2019 and 2021, 825 municipal property items (76% of all privatized properties) were sold through buyout. However, the use of the buyout mechanism decreased by 40% in the following years. In addition to the impact of military operations, which generally hindered municipal property privatization (with the number of auctions also falling by 41%), this decline may also be attributed to the approval of a new Procedure for granting tenants consent to make integral improvements to leased state property in August 2022.

Although this document is primarily applied to the rental of state-owned property, 63% of responding local authorities use it because they have not adopted their own procedure.

According to Article 18 of the Law of Ukraine “On Privatization of State and Municipal Property,” the tenant must obtain consent to make integral improvements to leased property, which is one of the mandatory conditions for the right to buy it out. At the same time, the updated Procedure has partially complicated the process for obtaining consent, as the lessor and balance holder are now required to submit additional documents, including:

- property valuation report and reviews;

- certificates from the balance holder regarding the condition of leased property that prevent it from being used for its intended purpose;

- conclusion of the construction expert examination on compliance of the estimate with state construction standards.

However, local authorities can simplify this procedure by approving their own guidelines for granting consent to implement integral improvements to leased property, which may lead to tenant abuse.

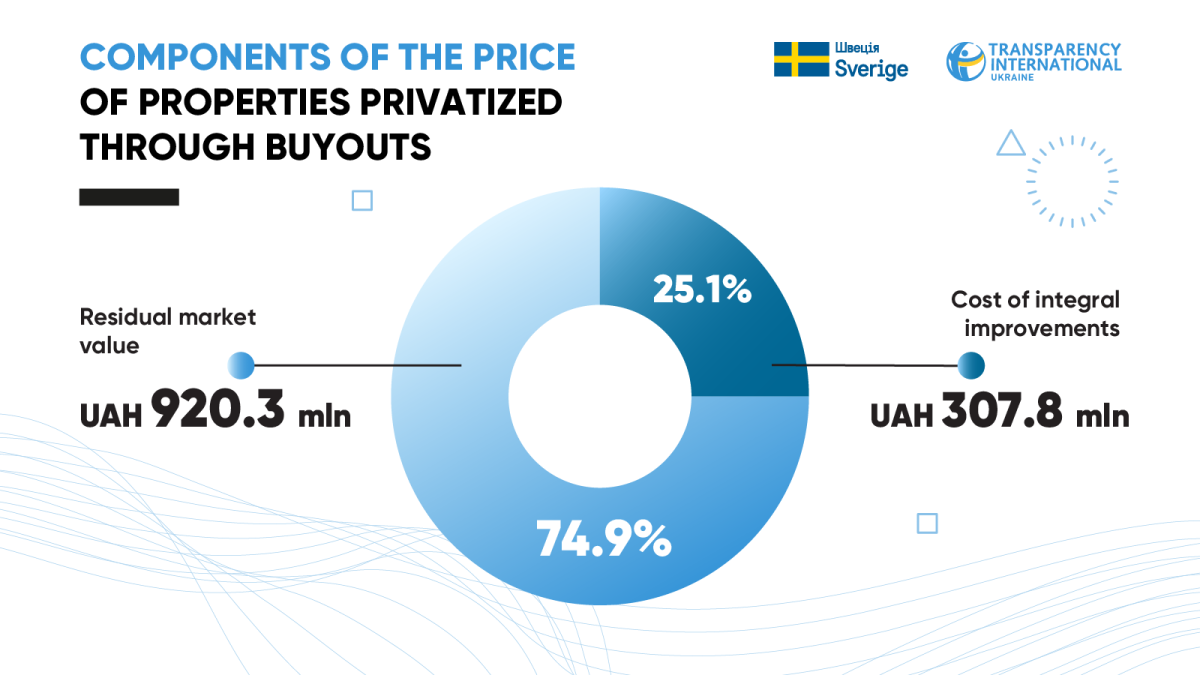

Noteworthy in this regard are the statistics on the cost of integral improvements to properties that were later privatized through buyouts. According to information from local authorities, the total cost of properties privatized through buyouts amounted to UAH 1.22 billion, with the cost of integral improvements totaling UAH 307.8 million (25.01%). This indicates that tenants of municipal property are limited to making inherent improvements of at least 25% of the property’s market value in order to gain the right to purchase it without competition.

How much money did privatization bring to local budgets

The total value of all privatized municipal property items since 2019 in the analyzed cities was UAH 4.77 billion.

The total starting price of properties privatized at auctions amounted to UAH 2.4 billion. Due to competition during bidding, their final value rose to

UAH 3.4 billion. The average price increase at auctions for municipal property privatization from January 2019 to October/November 2024 was 47%.

Cities with the highest average price growth rate at auctions (<20 privatized properties)

| City | Starting price, UAH million | Price of privatized properties, UAH million | Average price increase at auctions (%) |

| Korosten | 8.297 | 31.866 | 284 |

| Kharkiv | 43.959 | 136.001 | 209 |

| Cherkasy | 14.240 | 37.980 | 167 |

| Kyiv | 263.668 | 689.543 | 162 |

| Vinnytsia | 38.041 | 82.908 | 118 |

| Kryvyi Rih | 19.702 | 40.184 | 104 |

| Ternopil | 15.098 | 30.144 | 100 |

| Chernihiv | 23.947 | 40.797 | 70 |

| Dnipro | 110.265 | 171.060 | 55 |

| Chernivtsi | 149.719 | 228.368 | 53 |

The total sale price of municipal properties privatized through buyouts accounted for just over a quarter of the total value of all privatized assets, amounting to UAH 1.23 billion.

Cities with the highest total value of privatization items (UAH thousand)

| City | Privatization by sale

at auctions |

Privatization through buyouts | Difference in the average cost of buyout compared to sales

at auctions |

||||

| Items sold | Total price, UAH million | Average item price, UAH million | Items sold | Total price, UAH million | Average item price, UAH million | ||

| Lviv | 339 | 980.231 | 2.892 | 4 | 1.454 | 0.363 | -87.42% |

| Kyiv | 53 | 689.543 | 13.010 | 60 | 207.182 | 3.453 | -73.45% |

| Odesa | 131 | 269.749 | 2.059 | 183 | 197.310 | 1.078 | -47.63% |

| Dnipro | 158 | 171.060 | 1.083 | 200 | 221.962 | 1.110 | +2.44% |

| Chernivtsi | 62 | 228.368 | 3.683 | 18 | 17.224 | 0.957 | -74.03% |

| Zhytomyr | 16 | 98.011 | 6.126 | 51 | 81.479 | 1.597 | -73.91% |

| Kharkiv | 181 | 136.001 | 0.751 | 0 | 0 | 0 | |

| Vinnytsia | 30 | 82.908 | 2.764 | 21 | 38.201 | 1.819 | -34.17% |

| Uman | 22 | 90.440 | 4.111 | 19 | 16.380 | 0.862 | -79.02% |

| Ivano-Frankivsk | 33 | 59.944 | 1.816 | 46 | 44.177 | 0.960 | -47.13% |

| Rivne | 11 | 23.150 | 2.105 | 35 | 77.013 | 2.200 | +4.36% |

| Cherkasy | 25 | 37.980 | 1.519 | 17 | 39.709 | 2.336 | +34.96% |

| Zaporizhzhia | 7 | 10.068 | 1.438 | 42 | 61.629 | 1.467 | +1.99% |

| Ternopil | 32 | 30.144 | 0.942 | 10 | 39.844 | 3.984 | +76.36% |

| Khmelnytskyi | 20 | 37.983 | 1.899 | 3 | 26.731 | 8.910 | +78.68% |

| Kryvyi Rih | 61 | 40.184 | 0.658 | 60 | 14.910 | 0.248 | -62.27% |

The sale price of municipal properties, whether through auction or buyout, can vary significantly based on factors such as type, size, location, and other characteristics. Therefore, for this comparative analysis, we used the average sale price of assets for each mechanism.

An analysis of data from local authorities revealed a significant variation in the average cost of properties sold at auction versus those privatized through buyouts, depending on the locality. In 28 cities, auctioned properties generated more income than those privatized through buyout, with Lviv, Kyiv, Zhytomyr, and Chernivtsi seeing increases of 70% or more.

Conversely, in Ternopil, Khmelnytsky, and 17 other cities, income from the buyout of municipal property exceeded that generated by auctions.

Overall, in cities where both privatization mechanisms were used, the sale price of properties purchased through competitive auctions averaged 45% higher than those privatized through buyouts.

Considering this indicator, cities that used the buyout mechanism could have potentially lost over UAH 552 million since 2019 due to the non-competitive sale of assets.

Cities with the highest potential budget losses

| City | Number of privatized properties (buyout) | Price of privatized properties (buyouts) (UAH million) | Frequency of buyout applications | Potential budget losses (UAH million) |

| Dnipro | 200 | 221.962 | 56% | 99.883 |

| Kyiv | 60 | 207.182 | 33% | 93.232 |

| Odesa | 183 | 197.31 | 58% | 88.790 |

| Zhytomyr | 51 | 81.479 | 75% | 36.666 |

| Rivne | 35 | 77.013 | 73% | 34.656 |

| Zaporizhzhia | 42 | 61.629 | 86% | 27.733 |

| Ivano-Frankivsk | 46 | 44.177 | 51% | 19.880 |

| Ternopil | 10 | 39.844 | 24% | 17.929 |

| Cherkasy | 17 | 39.709 | 40% | 17.869 |

| Vinnytsia | 21 | 38.201 | 38% | 17.190 |

| Sumy | 76 | 25.150 | 85% | 11.317 |

Conclusion

From January 2019 to October/November 2024, over a third of all privatized municipal properties were acquired through the buyout of leased assets. However, the total sale price of these properties accounted for just over a quarter (UAH 1.23 billion) of the total value of all privatized assets (UAH 4.77 billion).

An analysis of data from local authorities on municipal property privatization revealed that the average value of properties sold at auction is 45% higher than those privatized through buyouts. Based on this indicator, the budgets of cities using the buyout mechanism may have lost approximately UAH 552 million over nearly six years. Therefore, the economic impact of the buyout mechanism is significantly lower compared to the competitive privatization of properties.

Given this, it would be prudent to reconsider the approach to municipal property privatization and eliminate the tenant’s right to non-competitive buyout of property. An alternative could be the auction mechanism, with the tenant’s pre-emptive right to purchase the property at the highest price offered during the auction. This practice is already used in certain areas, in particular land auctions.

This mechanism in privatization is outlined in draft law No. 12215, and TI Ukraine supports its adoption by Parliament to ensure more effective management of municipal property.

Contributors

Ivan Lakhtionov, Deputy Executive Director for Innovative Projects, Transparency International Ukraine

Authors of the study:

Andrii Shvadchak, Legal Advisor at Transparency International Ukraine

Viktoriia Hermasheva, Project Assistant at Transparency International Ukraine

This publication was prepared by Transparency International Ukraine with the financial support of Sweden.